From the creation of digital currencies to their integration with the blockchain digital ledger (i.e. Bitcoin), to the introduction of smart contracts on the blockchain (i.e. Ethereum), to the more recent introduction of Decentralized Exchange (DEX: Decentralized Exchange) and the proliferation of decentralized applications (DAPPs), blockchain technology has come a long way and seems set to continue. However, while the dream of fully decentralized finance (Defi) seems to have become very popular among tech enthusiasts who continue to develop this infrastructure, it has yet to materialize. As a result, more Defi innovations are still being developed.

Smart contracts are at the heart of decentralized financial infrastructure as they govern the execution of transactions on the blockchain. In relation to blockchain’s business and technical aspects, smart contracts play a key role. They are basically financial management protocols written in a code format that govern transactions on decentralized systems of record such as blockchain. However, smart contracts on currently available and widely used blockchains such as the Bitcoin blockchain and the Ethereum blockchain have centralized management methods. This limits the current capabilities of blockchain technology.

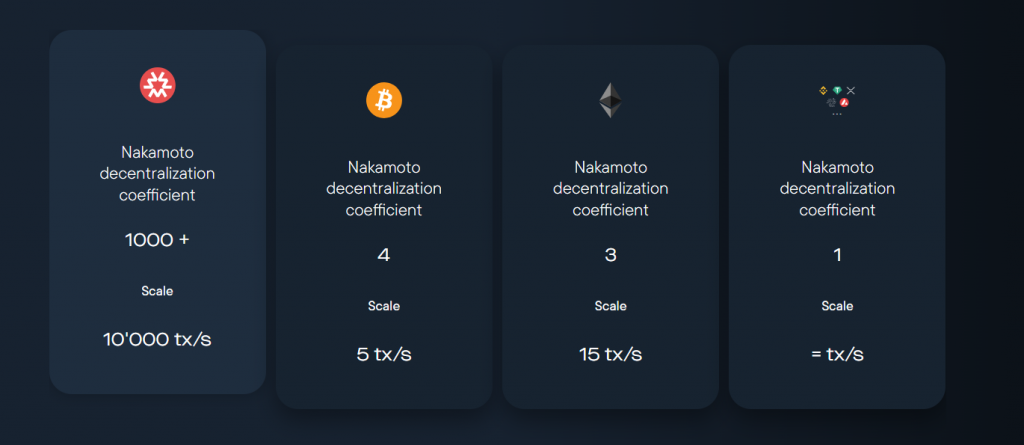

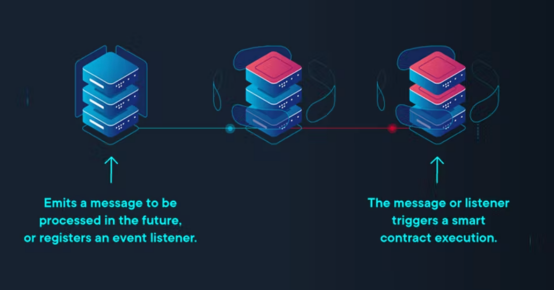

Currently, smart contracts need to be triggered to function. This means the smart contract code is dormant on the blockchain until a specific event (such as a transaction, update or configuration request, etc.) is initiated by the blockchain user and causes the appropriate smart contract to wake up and perform a task (i.e. trigger). This reactive thinking leads to blockchains being managed by centralized servers or bots (to coordinate user requests and smart contract functions). This centralized control limits usable blockchains because it reduces the security of the blockchain and ultimately defeats the purpose of decentralization.

Combined with other factors such as architecture and consensus protocols (Proof of Work vs. Proof of Stake), this centralized management of smart contracts leads to a well-known problem in blockchain technology referred to as the “triple dilemma.” This basically means that blockchains currently have to sacrifice scalability, security, or decentralization in their operations. Scientists are currently exploring a variety of ways to try to solve this “trilemma” problem. Recently, there has been a breakthrough in the introduction of autonomous smart contracts on a new blockchain known as the Massa blockchain.

Autonomous smart contracts solve this “trilemma” by being able to operate independently of external triggers, thereby minimizing the need to centrally manage them, thereby promoting the three factors of scalability, security, and decentralization, not at the expense of any factor. This is the main idea behind the development of the Massa blockchain by three French scientists. Currently, they have released a beta version of the blockchain for public access.

Next, we will further explore autonomous smart contracts and their implications for the future of blockchain technology.

Understanding the “Triple Dilemma”

Blockchain technology is currently limited by the “triple dilemma,” a long-standing problem in computer science involving the mutual limitations of security, scalability, and decentralization. According to the Cryptopedia.com website, this problem was first discovered by early computer scientists as the CAP (Consistency, Availability, and Partition tolerance) theorem. The CAP theorem describes how decentralized data storage can only guarantee two of the three critical properties listed (namely, consistency, availability, and partition tolerance). Because blockchain is essentially a decentralized data store, this CAP theorem also applies to it, which is what leads to the “triple dilemma”.

Public chains must choose between scalability, security, and decentralization in their operations. An accepted blockchain premise is known as the “trilemma.” For example, with well-known blockchains such as Bitcoin and Ethereum, transactions are mostly between scalability and decentralization. This problem is mainly due to the architecture of existing blockchains. In existing architectures, it uses a proof-of-work consensus protocol to verify on-chain activity, specifically a slow linear node-to-node approach in Bitcoin. Validating activities (such as transactions) on the blockchain by consulting multiple nodes on the chain (i.e. consensus) is necessary to ensure security and decentralization. As more nodes are added to the blockchain, a problem arises because validating transactions with nodes takes more time, which affects scalability. On the other hand, however, solving this problem by using fewer nodes for validation affects decentralization and security (i.e. hackers can easily spoof a few nodes and manipulate the blockchain). Hence the so-called “triple dilemma”.

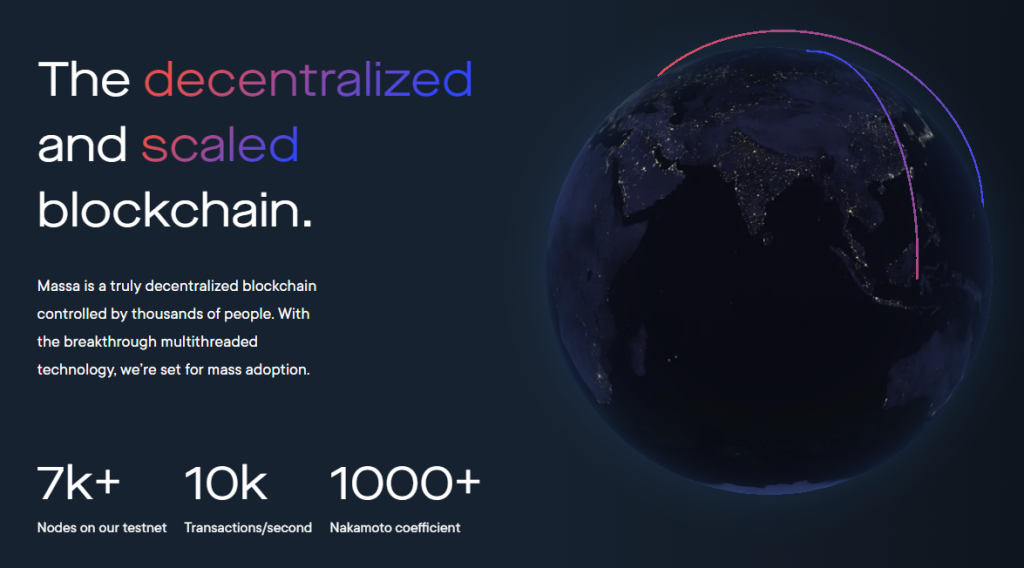

The centralized management of smart contracts through servers or centralized bots further magnifies this already existing problem. Servers can be hacked, bots can get wrong, and the scalability of centralized systems is limited. Ultimately, this centralized control limits the goal of decentralization. The trade-off between scalability and decentralization in blockchains can be measured using the Nakamoto Decentralization Coefficient (“NDC” for short). Therefore, the concept of autonomous smart contracts has been developed in order to solve the problems of decentralization and scalability in existing blockchains. The graph below shows that the decentralization and scalability of the Massa blockchain are greatly improved through autonomous smart contracts. This is compared to the Bitcoin blockchain, Ethereum blockchain, and other blockchains.

Comparing the Massa blockchain to other blockchains without autonomous smart contracts (Source: beincrypto.com)

Therefore, the introduction of autonomous smart contracts to solve the trilemma can be said to be a key “game rule adjustment” in the decentralization of blockchain technology.

Solving the “Three Dilemmas”

In fact, scientists have considered many solutions for different blockchains, trying to solve the “trilemma” problem. Listed below are some of the more well-known solutions.

- Bitcoin introduced the Lightning Network. The network introduces a second layer for off-chain transactions across multiple payment channels.

- Ethereum proposes a dual proof-of-stake model that includes an execution layer for smart contracts and a consensus layer for transactions.

- According to reports, Algorand has successfully solved the “trilemma” problem using its Pure Proof of Stake model.

- There are also reports that the Massa project’s approach to using autonomous smart contracts has also successfully solved this dilemma.

As the title suggests, our discussion in this article focuses on the autonomous smart contract approach. This kind of contract not only solves the “trilemma” problem but also provides a new automatic decentralization layer in blockchain technology.

Massa Project

The Massa project was launched in 2017 by Sebastian Forestier (CEO), Damir Vodnikalevich (head of development and technology), and Adri Initiated by Ann Laversani Fino (Head of Corporate Strategy). Their goal is to solve the aforementioned “trilemma” by creating autonomous smart contracts

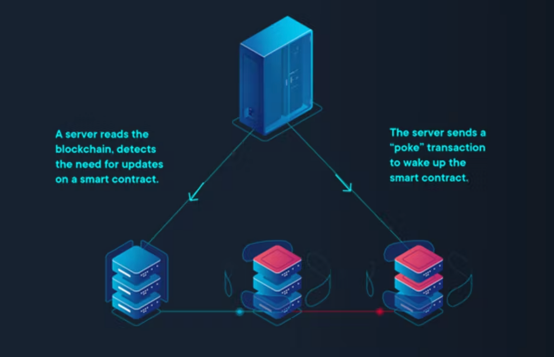

According to massa.net, the team achieved this by creating a brand-new blockchain (MASA). This blockchain combines proof-of-stake consensus (which prioritizes value on the blockchain when validating activity) and multi-threaded block graphs (facilitating parallel block creation) into an efficient new system of blockchain capabilities, called blocklike. They then developed autonomous smart contacts triggered by information stored on-chain, features that enabled their blockchain to run thousands of low-energy operations in a second.

Through autonomous smart contracts, the Massa project successfully promotes the decentralization and scalability of the blockchain. According to a Cryptonews.com report, this is the first blockchain with 1,000 NDCs, along with other perks such as decentralized web hosting. The testnet phase of Massa Blockchain, which launched in 2021, has reportedly managed to attract more than 7,000 actively running nodes. It also crossed the threshold of 4,000 transactions per second. The release of a new version of the mainnet (official blockchain) will improve the weaknesses of the testnet, targeting a throughput of around 10,000 transactions per second. This is a huge advancement in blockchain technology.

Smart Contracts and Autonomous Smart Contracts

According to TechTarget.com, a smart contract is a decentralized program that executes business logic in response to a specific event that triggers it. Smart contracts are often developed by business professionals and programmers to manage activities such as value exchange, service delivery, unlocking of protected content, and decentralized data storage such as blockchain. Because of this reactive thinking, a smart contract requires continuous management of its operation. Existing blockchains rely on centralized systems such as robotic networks or cloud infrastructure for automation. Nevertheless, this centralized management also magnifies the “trilemma” problem from yet another angle.

Due to the obvious problems caused by the centralized management of smart contracts, the MASA team developing autonomous smart contracts is said to have raised the following question;

“Why advocate for decentralization when you continue to rely on an apparently centralized way of interacting with smart contracts?”

Therefore, they came up with the concept of autonomous smart contracts to solve the trilemma through a new layer of decentralization. Therefore, autonomous smart contracts can be defined as smart contracts whose automation does not necessarily require external management, i.e., the ability to independently perform pre-assigned operations on the blockchain. It operates using blockchain data and can also request external information without additional administration.

Currently, only the Massa blockchain has this smart contract capability. This functionality is achieved by storing transaction and smart contract data on the blockchain. The smart contract can then access the data at any time for autonomous operation.

Autonomous smart contracts are increasingly recognized in decentralized finance. The CEO of Dusa, a maker of automated marketplaces built using the Massa blockchain, had this to say;

“Thanks to the autonomous smart contracts and blockchain custody of our web application, we are able to offer a 100% decentralized DeFi experience for the first time. These technological innovations allow us to fully autonomously execute users’ potential trading orders and optimize Clearing management, and all of this with full consideration of security protections for our users.”

conclusion

Finally, let’s analyze the impact of autonomous smart contracts on the future of blockchain. Considering how blockchain technology has evolved on an incremental basis, and the vast improvement that autonomous smart contracts have on the blockchain, it is reasonable to point out that existing blockchains such as Bitcoin and Ethereum may also implement autonomous intelligence contracts to break the “triple” dilemma. While there are other solutions to the “trilemma”, autonomous smart contracts stand out in that, in addition to solving the “trilemma”, they promote decentralization, which is fundamental to the creation of cryptocurrencies in an automated manner in principle. So, while it is impossible to predict the future with certainty, autonomous smart contracts appear to be a breakthrough technology that will change blockchain technology in a big way.