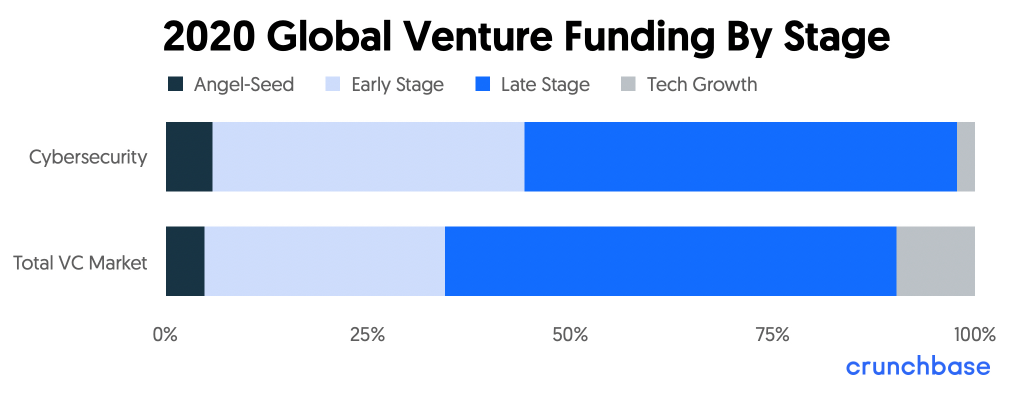

Relative to the global market as a whole (angels, seed and early-stage investments make up 35% of total investment), the cybersecurity industry is more focused on early-stage investments, with angels, seed and early-stage investments making up 45% (click here to delve into nine Biggest A and B rounds). That’s good news for salespeople and unicorn hunters — an industry with a lot of early-stage companies brings new funding and opportunities.

The biggest deal of 2020 was a $340 million Series G funding round for California-based cloud security company Netskope, which valued the company at $3 billion. The biggest exit was private equity firm Thoma Bravo’s $1.2 billion acquisition of Utah-based Venafi.

Global cybersecurity companies have raised 15 funding rounds totaling more than $100 million in 2020 — including two rounds for endpoint protection company SentinelOne ($200 million in Series E and $267 million in Series F), and application security Two rounds of financing for the developer. Snyk ($150M Series C and $200M Series D). Snyk has since gone on to raise a $300 million Series E in March 2021. At the time, the cybersecurity industry had the most funding rounds of more than $100 million in a year, a number that has already been reached by 2021.

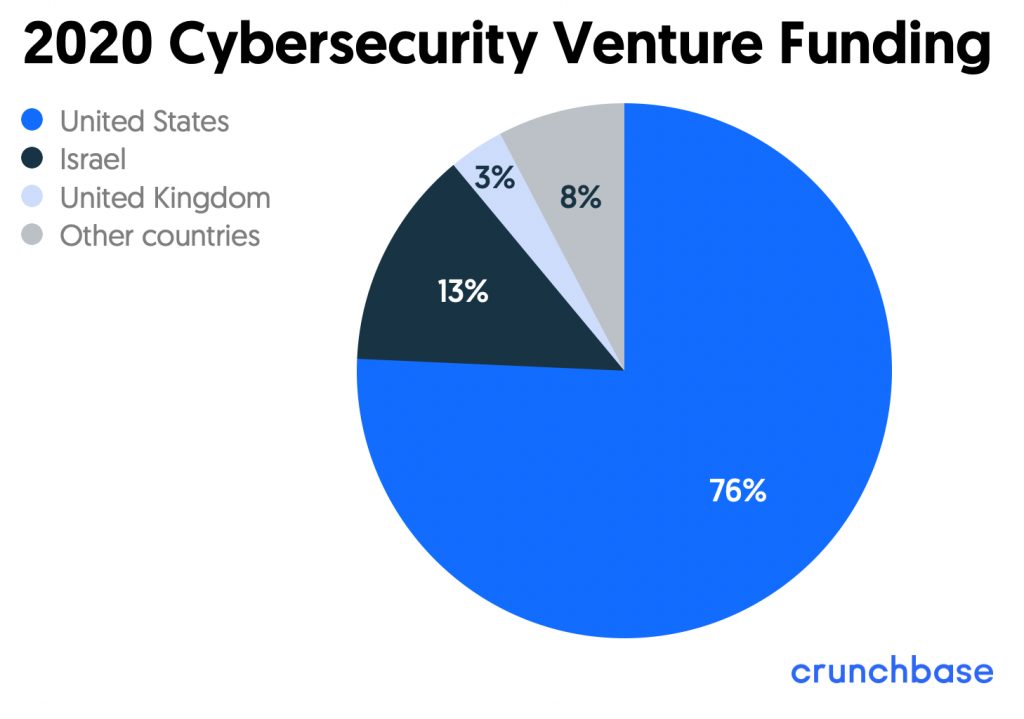

Hot spots for global cybersecurity investment in 2020

In 2020, the U.S. and Israel together accounted for nearly 90 percent of all venture capital in cybersecurity firms. The U.K. received just over 3 percent ($262 million) in funding in 2020, largely due to data privacy firm Privitar’s $80 million Series C round. Another cybersecurity firm from the UK worth mentioning is Darktrace, a cyber AI firm that achieved unicorn status in 2018 and is planning a London IPO in the first half of 2021, according to reports that the firm’s The valuation will reach $5 billion.

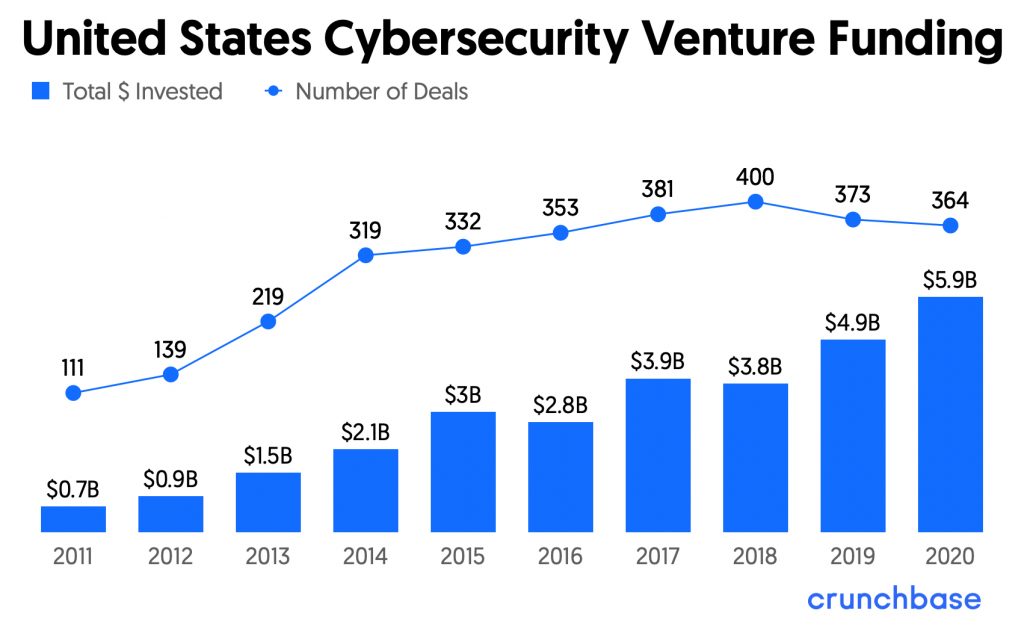

2020 U.S. Cyber Security Investment Directions

In the U.S., 2020 accounted for 76% of global VC funding for cybersecurity companies, with $5.9 billion in funding.

From 2019 to 2020, U.S. cybersecurity funding grew by 22%, significantly outpacing the 15% increase in the overall U.S. VC market. In 2020, 39% of cybersecurity funding went to angel, seed and early stage funding, less than the 45% figure for angel, seed and early stage cybersecurity deals globally. As the most mature cybersecurity market in the world, the U.S. sees a higher percentage of late-stage deals.

In 2020, 48% of U.S. cybersecurity firm funding ($2.9 billion in total) was concentrated in California. This is in line with California’s overall U.S. investment market share of 52% in 2020. Of the $2.9 billion invested in cybersecurity, 94 percent went to companies based in the San Francisco Bay Area.

California’s leader, New York sees a piece of the pie.

While the Bay Area is (unsurprisingly) a major hub for investment in the industry in the U.S., there are still plenty of opportunities across the country. The New York-based cybersecurity firm raised $874 million in 2020, almost 15 percent of U.S. cybersecurity funding that year. That year also marked New York’s best-ever investment in the industry — a 63 percent increase in funds raised over 2019 compared to the previous record year. Nearly 100 percent of New York State’s cybersecurity investment goes to New York-based companies.

Massachusetts, Texas, Minnesota and Maryland have a strong presence in the market.

Another notable state is Massachusetts, which accounted for 12% of U.S. cybersecurity funding in 2020 (almost only concentrated in Greater Boston). area). In fact, Massachusetts has always had a strong presence in the market, accounting for about 12 percent of cybersecurity funding. the past ten years. Massachusetts has received 18% of U.S. cybersecurity funding as of 2021, thanks to Snyk’s $300 million Series E and iboss’s $145 million Series B.

Part of the reason for the concentration of cybersecurity in the Boston area is the relocation of Israeli cybersecurity companies to the area. Snyk and Cybereason, for example, both have Israeli founders, but decided to establish their headquarters in Boston, in part because the US has a large customer base. Other reasons for these companies to choose Massachusetts include proximity to technical talent and controllable time compared to Israel (where many R&D offices are located).

Other states with stakes in the U.S. cybersecurity industry in 2020 include Texas (particularly the Austin and Dallas metro areas) with 7%, Minnesota (mainly thanks to the Arctic Wolf) and Maryland with about 4% each.

Israeli investments in cybersecurity

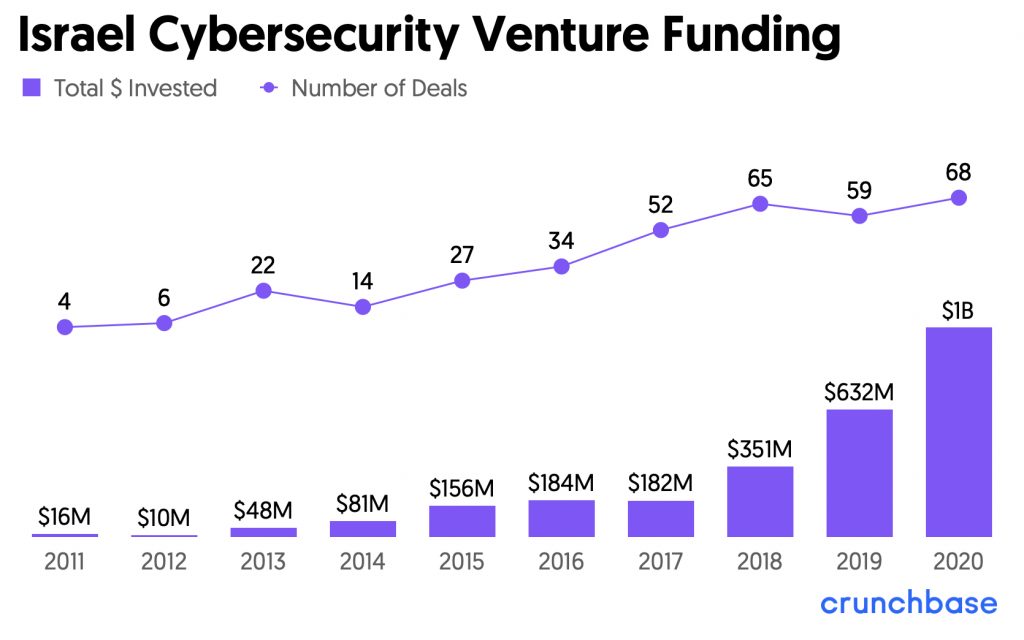

Looking at the U.S., Israeli cybersecurity funding will exceed $1 billion in 2020, an increase of nearly 65 percent from 2019. Interestingly, more than 90% of this $1 billion was raised in April or later after the pandemic hit.

More than 20% of Israel’s total venture capital investment in 2020 went to cybersecurity companies, compared to 2.5% of the total global funding for cybersecurity companies. This is a significant increase in the percentage of total investment in the country devoted to cybersecurity – the previous high was 15% in 2019. So far in 2021, cybersecurity companies will receive 28 percent of the country’s venture capital.

53% of Israel’s cybersecurity VC deals in 2020 were angel, seed, or early-stage, compared to 39% in the U.S., showing that VC investment in Israel is still in its infancy. About 80 percent of Israel’s cybersecurity funding in 2020 was concentrated in Tel Aviv, home to large venture-backed cybersecurity firms including BioCatch, Aqua Security and Cato Networks. We expect total Israeli funding to continue to climb as these early-stage companies receive larger, late-stage deals.

Although Israel may seem new to the cybersecurity space based on reported venture funding, Israel has been a major focus for the country over the years. The Israeli government has been very active in emphasizing the importance of cybersecurity and guiding the development of Israeli technology. In 2012, the Prime Minister’s Office established Israel’s National Cyber Administration, specifically charged with promoting cybersecurity in the country. In 2017, the bureau released the Israel Cyber Defense Methodology, a guide on how to minimize cyber risks to Israeli organizations. Over the past decade, Israel’s emphasis on risk and protecting the business, along with the rise of technology and venture capital, has fueled a boom in cybersecurity technology.

Israel has established companies in the market for years, most notably Check Point, but it is also home to the second offices of many US cybersecurity firms including Snyk, BigID, Cybereason, Axonius, and more. The recent boom in emerging cybersecurity firms has also resulted in nearly 50% of risk-backed cybersecurity firms in Israel founded in 2016 or later. Given the high percentage of early-stage funding in the country, we expect funding to cybersecurity companies to continue to grow in Israel.