The NFT lending market is still in its infancy. This article analyzes the three types of project operation mechanisms, advantages, and disadvantages of point-to-point, point-to-multiple (point-to-pool), and CDP lending in the NFT lending market.

NFT lending platforms allow users to borrow liquid assets by staking their NFTs. In this article, we’ll dive into peer-to-peer, peer-to-pool, and CDP lending in NFTs to understand this growing trend

One of the challenges of investing in NFTs for the long term is money management. Holding NFTs means locking up a lot of money in illiquid investments that can drop within a few days.

Overcollateralized NFT lending protocols (such as Compound, Aave, and Maker in traditional DeFi) allow users to release a portion of liquidity in their NFT portfolio without losing risk to the NFT. Let’s take a look at how different projects achieve this goal.

Peer-to-Peer

In P2P lending, borrowers connect directly with lenders. This is the main method of NFT lending today. Peer-to-peer lending platforms include NFTfi, TrustNFT, Pawnfi, and Yawww.

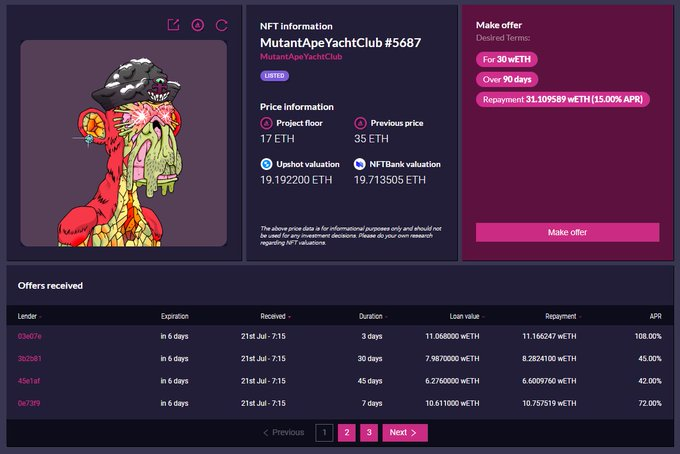

These platforms typically require users to lock up NFTs in escrow contracts as collateral and then apply for a loan for a specific period of time. Finally, users will receive offers from others for mortgages and interest rates.

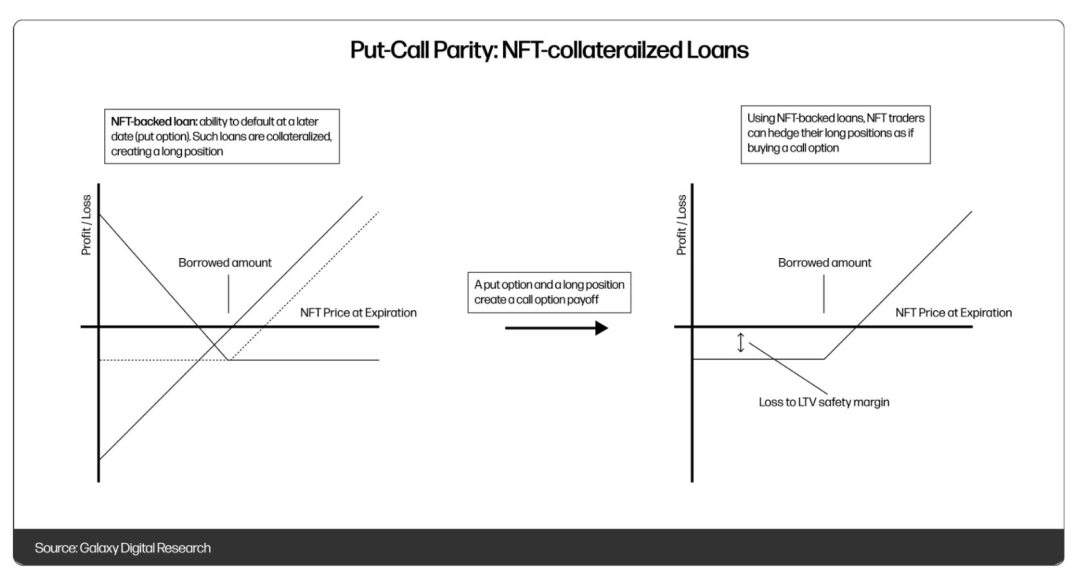

Such bids typically result in a combination of various Loan-to-Value ratios and interest rates, from which NFT owners can choose the one that works best for them. This is why peer-to-peer lending is great for hedging NFT risks.

This kind of loan is like a put option (if the NFT price is lower than the borrowed amount, then the user better default). By owning an NFT (in a contract) and having a put option on it, a user can create a payoff scenario for a call option, avoiding losses beyond a stated price.

Another thing experienced traders do with P2P lending is leverage. For example, a user can borrow $50,000 by locking one BAYC NFT and buying two MAYC NFTs. If their price goes up, they only need to return $50,000 plus interest, and they can make a profit.

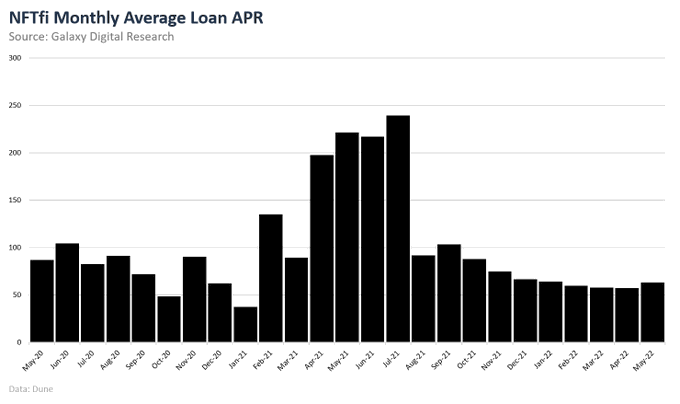

Peer-to-peer loans typically have very high-interest rates and moderate loan-to-value ratios. Of the platforms we analyzed, NFTfi has the most traction, with $28.6 million in debt currently outstanding. Last month, the average annual interest rate was 63%.

Peer-to-Pool

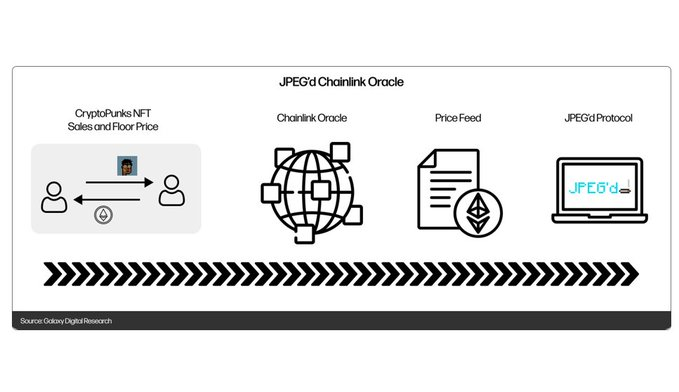

Drops operate a Compound-like money market where users can stake NFT portfolios for loans in USDC and ETH. NFTs are priced by a Chainlink oracle that adjusts for outliers and averages over time.

From the user’s perspective, they deposit NFTs as collateral and lend funds from the pool at variable rates. These funds are provided by lenders who earn interest rates from borrowers.

Like Compound and Aave, Drops uses a piecewise interest function that targets a specific utilization rate where borrowers pay significantly higher rates when there are not enough funds for withdrawals.

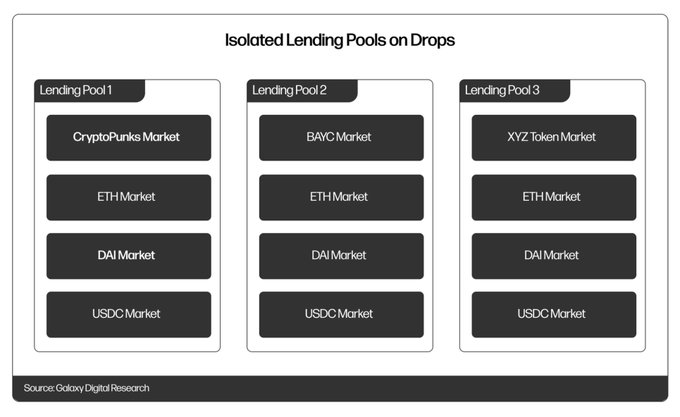

To limit exposure to liquidity providers, Drops divides the protocol into separate pools, each with its own collection of NFTs. This is similar to how Fuse works at Rari Capital. This ensures that lenders can choose their preferred collection.

Drops currently have $2.6 million in supply capital and $388,000 in outstanding borrowings. They offer moderate LTV ratios to ensure solvency and relatively low-interest rates (around 10% APR for the Yuga Labs vault).

Other peer-to-peer NFT mortgage lending protocols BendDAO and BailoutFi iterate on this design. BendDAO provides borrowers with 48-hour liquidation protection, and Bailout limits loan terms to 30 days to ensure solvency.

The peer-to-peer NFT mortgage lending protocol is like the peer-to-peer money market in DeFi, only accepting blue-chip assets as collateral. For these protocols to work, there needs to be an oracle infrastructure and a stable floor price.

Collateralized Debt Position

The CDP, pioneered by MakerDAO, is the ultimate model for the NFT collateralized currency market. JPEG’d is a lending protocol that leverages CDPs to lend and borrow NFTs.

After users deposit NFTs as collateral in the vault, they can mint PUSd, a stablecoin pegged to the U.S. dollar. JPEG’d allows PUSd debt positions up to 32% of the collateral value, priced through Chainlink oracles. The agreement only charges 2% annual interest.

On JPEG’d, when a given user’s debt/collateral ratio exceeds 33% (40% with a pledged Cigarette NFT card), liquidation is performed exclusively by the DAO. The DAO repays its debt and retains or auctions off NFTs, thereby building up its treasury.

Users can purchase liquidation insurance with a one-time, non-refundable payment of 5% of the loan amount at the time of the loan. This gives users the option to repay the debt themselves (with penalties) within 72 hours of liquidation.

JPEG’d raised $72 million in February 2022 through a “donation drive.”

It looks like an ICO, swims like an ICO, quacks like an ICO, but it’s not an ICO.

CDP loans via JPEG are great for those looking to get some liquidity from blue chip NFTs without paying high-interest rates.

NFT mortgage lending is still in its infancy, and in my opinion, it has a lot of room to grow in a bear market. However, it is important to exercise caution when trying out these protocols as they are very dependent on oracle performance and market stability.